Hill Dickinson survey reveals changing attitudes to the Laspo reforms

People are now less optimistic about the benefits of the Legal Aid, Sentencing and Punishment of Offenders (Laspo) reforms than they were before the regulations came into force in April.

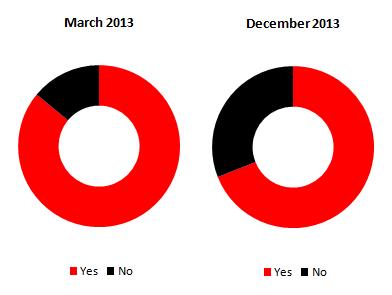

A recent survey from Hill Dickinson revealed that 69% believe the reforms will reduce overall spend, down from 86% in March 2013 (see below).

Will the reforms reduce overall spend?

Hill Dickinson head of costs Paul Edwards said the change may be a sign of the pre-reform optimism dissipating as the reality takes hold.

“Maybe in March people were more enthusiastic because of some of the spin about how good the reforms were going to be, and maybe now the 69% is just a fairly reasonable number,” he said. “[It could also be] people are getting cynical because they are hearing about some of the stunts that claimant lawyers are pulling to try and take advantage of the new regime.”

Edwards also said that the new reforms were making it more likely that a case would be defended by the insurer, which could also drive up costs – but not as high as levels seen before the reforms.

“The one key point is that a lot of people think the portal is the be-all and end-all, but what we can show clients now is statistically whether it’s in the portal or on the fast-track fixed costs regime, they are still saving a lot of money compared with previously,” he said. “Clients now have the power to make the right decisions at the right time.

“The portal is only intended to work for the most straightforward case where you know liability has to be admitted on day one and you do need to roll-over, but there are quite a few cases where you are not sure or you want to wait for the right moment to settle it because you need to do a bit more investigating and see if there’s a policy reason to defend the case.

“But now they can look at it and say if it falls out of the portal it’s only going to cost us £X more, because you can now estimate the costs. That will give people more of a desire to defend cases, or at least contest them longer and settle at the right time.”

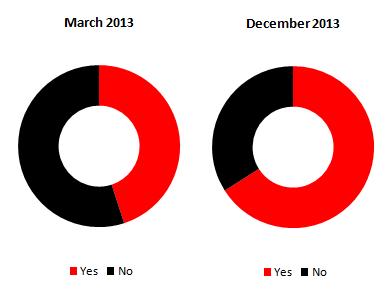

The survey also found that two-thirds of industry players believe the number of exaggerated and/or fraudulent claims will increase, compared with just 45% in March (see below).

Will exaggerated and/or fraudulent claims increase?

However, Edwards said that he believed the reforms would serve to reduce fraud, despite the results of the survey.

“The new regime will squeeze fraud and will reduce fraudulent cases,” he said. “Partly because of the fixed costs, but also with there being no success fees and no after-the-event fees and referral fees being banned, there’s no money sloshing round the system.

“Any slack in the regime has gone.”

Edwards did concede, however, that there would always be fraud in the insurance sector.

He said: “A lot of fraud is motivated by non-legal factors; it’s down to the economy. People aren’t sat at home thinking how they can get round the rules.”

No comments yet