15% of UK general insurance complaints to Ombudsman

Complaints about add-on policies make up 15% of the total number of complaints against general insurance companies, according to figures from the Financial Ombudsman Service (FOS).

The FOS received 2,976 complaints about add-on policies over the nine months to December 2013, compared to 20,226 for the total number of general insurance complaints (excluding PPI).

This is an increase of 4.3% on the 2,852 add-on complaints received over the same period in 2012.

The FOS said that the majority of these complaints related to the sale of the policy, with customers saying they didn’t want the insurance or were not aware they had bought it.

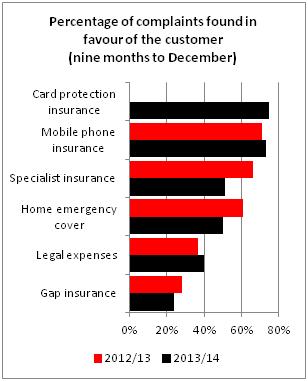

The number of complaints found in favour of the customer is also very high for many of the add-on products the FOS receives complaints about. Card protection insurance was the most likely to have a complaint upheld, with three quarters of all complaints found against the insurer (see chart below). This compares to an uphold rate of 40% for all general insurance complaints over the second half of 2013.

The FCA this morning said there was a “clear case” for intervention in the add-on market after a thematic review concluded competition was not working well and made a number of proposals to “prevent consumers paying for poor-value insurance products that they may not need or use.”

No comments yet