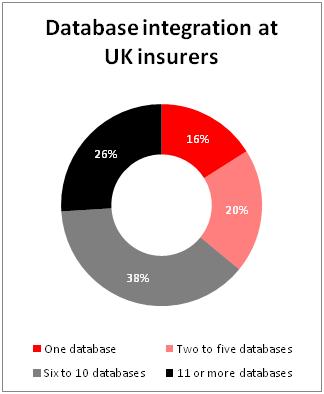

Just 16% of insurers have integrated their data into one universal set

Insurers are not capitalising on the potential of Big Data, according to research from IBM.

A survey by the global IT and technology provider has revealed that the UK insurance industry is still operating in a “siloed” environment, where information is not properly shared. Different business lines are not integrating the data they hold and are even failing to adequately capture data from their customers.

According to the survey, just 16% of insurers integrate data into one universal dataset (see below), and more than one-third do not integrate customer data into their IT systems.

IBM worldwide insurance industry leader Danny Lee (pictured) said: “[There is a] lack of integration between the distribution channels. Most insurance customers interact with insurance companies through two or three communications mediums to get information or get the transaction processing done.

“Now, the question is how can [insurers] share that information across different channels? Only 24% of the organisations that we surveyed were able to integrate their websites, mobile channels, call centres and face-to-face channels. That’s something the insurance industry in the UK can improve, and it is something they have to do well.”

Despite this lack of data integration, 88% of respondents said they were concerned that not integrating their customer data could have an adverse affect on sales.

The survey has also found that only half of the insurers surveyed are using business intelligence software (BIS) to analyse the data they have captured. Of those companies not using business analytics, 57% said they were performing poorly in winning new business and retaining customers. This compares with just 8% of the companies that are using BIS.

The use of BIS also enabled insurers to capture 76% of the data available from customers’ transactions, whereas those not using BIS could only gather 57% using basic spreadsheets and databases. Overall, only 4% of UK insurers could capture 100% of customer data.

Lee said: “This survey highlights the urgent need for IT to change from being the department that ‘keeps the lights on’ to instead becoming a genuine business driver through improved data management and analysis.

“The UK insurance industry needs to embrace the new wave of analytical technologies to realise the huge opportunity that big data presents.”

However, Lee acknowledged that the current economic situation meant that companies were looking for a quicker return on investment (ROI) before they sanctioned spending on IT initiatives.

“The age of taking a $100m and no one questions it and three years later you come back with a new system is over,” Lee said. “People are looking very carefully at the ROI. Technology can do so many things; there will not be a lack of creative ideas from a business. The question is what the ROI is and can you prove it? Now, everybody says if you can’t get returns in three months to nine months you are out.”

The survey questioned 50 senior IT decision makers at UK insurance companies.

Hosted by comedian and actor Tom Allen, 34 Gold, 23 Silver and 22 Bronze awards were handed out across an amazing 34 categories recognising brilliance and innovation right across the breadth of UK general insurance.

No comments yet