Research from Friends Life reveals that 21% of people insure their pets, while only 12% have critical illness cover

People are more likely to insure their pets than themselves, according to research from Friends Life.

The pension and protection provider found that 21% of people questioned had insurance for their pets, while only 12% had cover for critical illness.

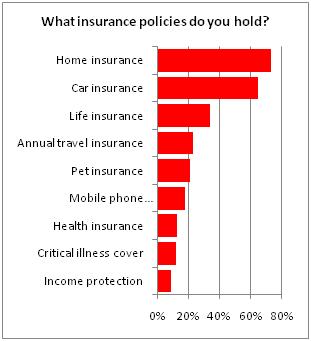

Top of the list for most common insurance cover was home insurance policies (73%), while income protection was the least popular type of policy (9%). See chart below.

This is despite pet health ranking bottom of the list of top worries and serious or life-changing injuries or accidents being the prime concern for 45% of respondents (see below).

Which of the following emergency events do you worry about?

| 1. Serious or life changing injury or accident | 45% |

| 2. Redundancy | 39% |

| 3. Burglary | 25% |

| 4. Unable to pay Mortgage / Rent | 20% |

| 5. Car problems | 14% |

| 6. Theft / Mugging | 14% |

| 7. None of the above | 14% |

| 8. Heating Problems | 10% |

| 9. Pet Health | 8% |

The research also found that 31% of Friends Life customers consider purchasing protection products as a luxury rather than a necessity.

Friends Life head of sales and marketing for individual protection Mark Anders said: “It is all very well being able to replace a cracked phone screen, but the ability to pay for ongoing medical treatment or pay off your mortgage when a serious accident or injury impacts your ability to work is a lot harder to fund, so it is important that people look into their personal insurance options to provide financial security and peace of mind for themselves and their family in case the worst happens.”

Hosted by comedian and actor Tom Allen, 34 Gold, 23 Silver and 22 Bronze awards were handed out across an amazing 34 categories recognising brilliance and innovation right across the breadth of UK general insurance.

No comments yet